Investment strategy models?

Investment models are designed to help investors achieve their long-term investment goals. By outlining investment objectives, risk tolerance, and investment time horizon, investors can develop a strategy that is tailored to their specific needs.

- Growth investing. Growth investing focuses on selecting companies which are expected to grow at an above-average rate in the long term, even if the share price appears high. ...

- Value investing. ...

- Quality investing. ...

- Index investing. ...

- Buy and hold investing.

- Stocks.

- Certificate of Deposit.

- Bonds.

- Real Estate.

- Fixed Diposits.

- Mutual Funds.

- Public Provident Fund (PPF)

- National Pension System (NPS)

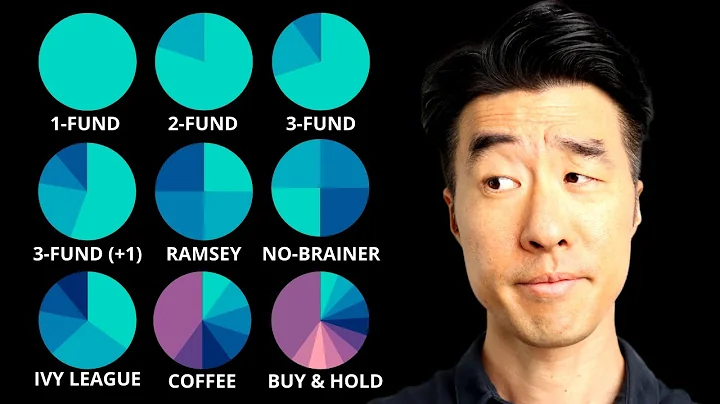

The three-fund portfolio consists of a total stock market index fund, a total international stock index fund, and a total bond market fund. Asset allocation between those three funds is up to the investor based on their age and risk tolerance.

An investment model is a strategy or plan that outlines how investors intend to allocate their assets and invest their money. The model depends on the individual's investment goals, risk tolerance, and investment time horizon.

Active investing involves the frequent buying and selling of stocks. It requires hands-on management, often by a portfolio manager who can delve into various factors to forecast the market. Passive strategies, on the other hand, are focused on buying and holding investments for the long haul.

Buy and hold

A buy-and-hold strategy is a classic that's proven itself over and over. With this strategy you do exactly what the name suggests: you buy an investment and then hold it indefinitely. Ideally, you'll never sell the investment, but you should look to own it for at least 3 to 5 years.

The name “7Twelve” refers to “7” asset categories with “Twelve” underlying mutual funds and/or exchange traded funds (ETFs). The seven asset categories include: US stock, non-US stock, real estate, resources, US bonds, non-US bonds, and cash. The 7Twelve model is shown below in Figure 1.

There are many types of investments to choose from. Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds.

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds, cash, real estate, and equity shares) with the expectation of capital appreciation, dividends, and interest earnings.

What is 4 3 2 1 investment strategy?

The 4-3-2-1 Approach

One simple rule of thumb I tend to adopt is going by the 4-3-2-1 ratios to budgeting. This ratio allocates 40% of your income towards expenses, 30% towards housing, 20% towards savings and investments and 10% towards insurance.

Buffett looks for companies with a durable competitive advantage, such as a strong brand, high barriers to entry, or a large and loyal customer base, and invests in them at a price that provides a margin of safety.

Buy-and-hold investments: Buy-and-hold investing refers to making an initial investment, and maintaining the asset until it appreciates. The simplest example of this is purchasing stocks and then selling them after the shares increase in value.

Return on Investment (ROI) is a popular profitability metric used to evaluate how well an investment has performed. ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay.

Taking inspiration from the Fama French five-factor model, we can develop a multi-factor stock selection strategy that focuses on five factors: size, value, quality, profitability, and investment pattern. First, we run a Coarse Selection to drop Equities which have no fundamental data or have too low prices.

There are five investment style factors, including size, value, quality, momentum, and volatility. The other type of factor investing looks at macroeconomic factors such as interest rates, inflation, and credit risk.

Best Investing Strategies: Buy and Hold. Buy and hold investors believe that "time in the market" is better than "timing the market." If you use this strategy, you will buy securities and hold them for long periods of time.

- Start with Your Goals and Time Horizon. ...

- Understand Your Risk Tolerance. ...

- Match Your Account Type with Your Goals. ...

- Select Investments. ...

- Create Your Asset Allocation and Diversify. ...

- Monitor, Rebalance and Adjust.

History shows that the most dependable way to create wealth is to take a long-term approach. The stock market can gain and lose value in unpredictable ways, but the best way to cope with volatility is to have patience. A patient investing approach prioritizes buying and holding quality companies for the long term.

While the product names and descriptions can often change, examples of high-risk investments include: Cryptoassets (also known as cryptos) Mini-bonds (sometimes called high interest return bonds) Land banking.

What is the best investment strategy right now?

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

- Funds.

- Stocks.

- Alternative investments and cryptocurrencies.

- Real estate.

- High-yield savings account (HYSA) ...

- 401(k) ...

- Short-term certificates of deposit (CD) ...

- Money market accounts (MMA) ...

- Mutual funds. ...

- Index funds. ...

- Exchange-traded funds (ETFs) ...

- Stocks.

5: The 10, 5, 3 Rule You can expect to earn 10% annually from stocks, 5% from bonds, and 3% from cash. 6: The 3-6 Rule Put away at least 3-6 months worth of expenses and keep it in cash. This is your emergency fund.

It's used to calculate the doubling time or growth rate of investment or business metrics. This helps accountants to predict how long it will take for a value to double. The rule of 69 is simple: divide 69 by the growth rate percentage. It will then tell you how many periods it'll take for the value to double.

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.

References

- https://treasuryxl.com/what-is-corporate-finance/

- https://quizlet.com/788141857/intro-to-business-quiz-flash-cards/

- https://finance.yahoo.com/news/want-rich-500-month-fund-113000805.html

- http://static.fmgsuite.com/media/documents/6292a648-34c7-44c6-a7e4-a153a89dff5b.pdf

- https://www.bajajfinserv.in/corporate-finance

- https://smartasset.com/investing/investing-200-a-month-how-much-will-you-make

- https://www.fool.com/the-ascent/buying-stocks/articles/heres-why-investors-love-the-3-fund-portfolio/

- https://mergersandinquisitions.com/corporate-finance-vs-corporate-development/

- https://www.experian.com/blogs/ask-experian/how-to-choose-investment-strategy/

- https://www.nasdaq.com/articles/do-this-for-$4000-in-dividend-income-every-month

- https://finance.yahoo.com/news/500-every-month-passive-income-130041730.html

- https://www.cafonline.org/charities/investments/understanding-strategies-and-styles-of-investing

- https://www.growthcapitalventures.co.uk/insights/blog/26-questions-to-ask-when-investing-in-a-startup-business

- https://seekingalpha.com/article/4496870-factor-investing

- https://time.com/personal-finance/article/best-investments-for-beginners/

- https://www.finnfund.fi/en/investing/financing/

- https://www.investopedia.com/terms/r/returnoninvestment.asp

- https://www.tataaia.com/blogs/financial-planning/sip-plans-for-5000-per-month.html

- https://www.bizmanualz.com/improve-accounting/whats-rule-69-accounting.html

- https://learn.marsdd.com/article/strategic-investment-deals-investing-in-complementary-tech-startups/

- https://www.titan.com/articles/what-is-an-investment-advisor

- https://en.wikipedia.org/wiki/Traditional_investments

- https://300hours.com/corporate-finance-career-path/

- https://www.ambitionbox.com/profile/investment-manager-salary

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://medium.com/@Levente22/9-smart-passive-income-ideas-to-make-3-000-per-month-e15154bd558e

- https://www.pwc.com/us/en/services/consulting/deals/corporate-finance/buy-side-services.html

- https://finance.yahoo.com/news/warren-buffetts-no-1-investing-132715262.html

- https://www.fca.org.uk/investsmart/5-questions-ask-you-invest

- https://smartasset.com/investing/investment-strategies

- https://fortune.com/recommends/investing/golden-rules-of-investing/

- https://www.investopedia.com/financial-edge/0709/so-you-wanna-be-a-millionaire-how-long-will-it-take.aspx

- https://www.amazon.com/Rule-Strategy-Successful-Investing-Minutes/dp/0307336840

- https://www.wallstreetmojo.com/corporate-finance-vs-investment-banking/

- https://www.pipiads.com/blog/how-would-you-turn-$25k-into-$1m-million-dollars/

- https://fortune.com/recommends/investing/safe-investments/

- https://www.bankrate.com/investing/ways-to-double-your-money/

- https://www.quantconnect.com/research/15262/fama-french-five-factors/

- https://www.linkedin.com/pulse/analysts-vs-strategists-complementing-business-femi-akin-laguda

- https://www2.deloitte.com/xa/en/pages/corporate-finance/topics/deloitte-corporate-finance.html

- https://www.investopedia.com/articles/investing/110615/investing-100-month-stocks-20-years.asp

- https://www.fca.org.uk/investsmart/understanding-high-risk-investments

- https://www.gmercyu.edu/academics/learn/finance-vs-accounting

- https://www.lazyportfolioetf.com/comparison/warren-buffett-vs-us-stocks/

- https://www.robomarkets.com/blog/stock-market/top-stocks/top-10-monthly-dividend-stocks-of-2022/

- https://www.bankrate.com/investing/investment-strategies-for-beginners/

- https://mergersandinquisitions.com/corporate-finance-career-path/

- https://www.maxlifeinsurance.com/blog/investments/types-of-investments-in-india

- https://www.investopedia.com/investing/investing-strategies/

- https://www.linkedin.com/posts/brianferoldi_10-investing-rules-of-thumb-1-rule-activity-7111321292770791424-bP7r

- https://www.cascade.app/templates/investment-strategy-template

- https://ukbusiness.finance/advice-hub/what-is-the-difference-between-corporate-finance-and-commercial-finance

- https://www.thebalancemoney.com/top-investing-strategies-2466844

- https://www.glassdoor.com/Salaries/investment-strategist-salary-SRCH_KO0,21.htm

- https://www.investopedia.com/terms/c/corporatefinance.asp

- https://money.stackexchange.com/questions/133870/what-is-the-difference-between-a-fund-and-a-strategy-and-can-you-compare-the-tw

- https://finance.yahoo.com/news/8-great-investments-generate-monthly-130000894.html

- https://www.investopedia.com/articles/professionals/100215/career-advice-investment-banking-vscorporate-finance.asp

- https://www.fool.com/retirement/strategies/asset-allocation-by-age/

- https://www.finsyn.com/whats-the-difference-between-financial-planning-vs-investment-management/

- https://www.investopedia.com/terms/i/investment-management.asp

- https://www.bankrate.com/investing/financial-advisors/when-to-get-a-financial-advisor/

- https://lyonswealth.com/blog-details/how-much-money-do-i-need-to-invest-to-make-3000

- https://www.linkedin.com/pulse/4-3-2-1-approach-financial-freedom-royston-tan-%E9%99%88%E9%9F%A6%E9%BE%99-chfc-asep-ibfa-

- https://www.investopedia.com/terms/i/investmentstrategy.asp

- https://careerswales.gov.wales/job-information/investment-manager/how-to-become

- https://finance.yahoo.com/news/10-return-investment-roi-141300511.html

- https://www.fe.training/free-resources/asset-management/investment-management-career-path/

- https://www.livewiremarkets.com/wires/how-to-use-the-5-10-15-rule-to-successfully-filter-companies

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.financestrategists.com/wealth-management/investment-management/

- https://www.fortunebuilders.com/investment-strategies-to-get-started/

- https://www.investopedia.com/articles/professionals/100515/top-5-highest-paid-hedge-fund-managers.asp

- https://www.quora.com/How-would-I-go-about-turning-5-000-dollars-into-20-000-with-investments

- https://www.clevergirlfinance.com/3-fund-portfolio/

- https://corporatefinanceinstitute.com/resources/fpa/corporate-finance-industry/

- https://smartasset.com/investing/the-difference-between-accounting-and-finance

- https://www.ruleoneinvesting.com/investing-guide/types-of-investments/

- https://www.pionline.com/largest-money-managers/2023

- https://www.investors.com/how-to-invest/investors-corner/how-to-build-long-term-profits-in-stocks-take-many-gains-at-20-25/

- https://www.rocketmortgage.com/learn/1-rule-real-estate

- https://www.fool.com/retirement/2023/12/19/3-ways-to-grow-100000-into-1-million-retirement/

- https://byjus.com/question-answer/financial-management-is-based-on-three-broad-financial-decisions-what-are-these/

- https://smartasset.com/financial-advisor/the-minimum-investment-for-a-financial-advisor

- https://www.graygroupintl.com/blog/investment-strategies

- https://finance.yahoo.com/news/why-saving-money-doesn-t-194845371.html

- https://www.investing.com/academy/trading/warren-buffett-investment-strategy-rules-fortune/

- https://groww.in/blog/peter-lynchs-investment-strategy

- https://www.forbes.com/advisor/investing/best-low-risk-investments/

- https://tools.carboncollective.co/future-value/100-in-20-years/

- https://gocardless.com/guides/posts/the-fundamentals-of-corporate-finance/

- https://www.indeed.com/career-advice/finding-a-job/jobs-that-pay-over-500k-a-year

- https://www.cfainstitute.org/en/programs/cfa/charterholder-careers/roles/investment-strategist

- https://www.investopedia.com/financial-edge/0711/how-to-double-your-money-every-6-years.aspx

- https://www.investopedia.com/terms/f/five-percent-rule.asp

- https://www.investopedia.com/articles/credit-loans-mortgages/090816/cfa-useful-corporate-finance.asp

- https://www.fool.com/investing/how-to-invest/stocks/investment-strategies/

- https://www.forbes.com/sites/pattieehsaei/2023/10/12/you-can-afford-to-invest-start-with-just-100-per-month/

- https://www.icaew.com/technical/corporate-finance/corporate-finance-faculty/what-is-corporate-finance

- https://www.investopedia.com/articles/financial-theory/09/how-investments-make-money-income.asp

- https://www.investopedia.com/ask/answers/050115/what-are-some-reallife-examples-8020-rule-pareto-principle-practice.asp

- https://testbook.com/ias-preparation/investment-models

- https://advisor.morganstanley.com/the-pathak-group/documents/field/p/pa/pathak-group/Portfolio%20Manager%20Work-Life%20Balance%20-%20White%20Paper%20%282%29.pdf

- https://www.forbes.com/advisor/investing/how-to-build-investment-portfolio/

- https://www.financialexpress.com/money/mutual-funds-how-much-will-you-get-after-20-years-by-investing-rs-5000-every-month-find-out-2243500/

- https://undergradcareers.nd.edu/career-paths/business-finance-consulting/corporate-finance/

- https://www.tipranks.com/news/personal-finance/which-investment-strategies-have-the-best-historic-returns

- https://www.schweser.com/cfa/blog/career-information/7-reasons-to-pursue-an-investment-management-career

- https://mergersandinquisitions.com/investment-banking-career-path/

- https://www.sofi.com/learn/content/70-20-10-rule/

- https://www.fool.com/the-ascent/buying-stocks/articles/heres-what-happens-when-you-invest-500-a-month/

- https://aifpms.com/blog/portfolio-managers-vs-investment-advisors-how-do-the-two-differ/

- https://fmi.online/how-can-you-earn-a-six-figure-salary-at-top-investment-banking-firms-without-any-experience-in-2023/

- https://www.indeed.com/career-advice/finding-a-job/what-is-investment-management

- https://fortune.com/recommends/investing/how-to-start-investing/

- https://www.quora.com/I-want-to-earn-1-000-USD-every-month-from-dividends-How-much-do-I-have-to-invest-and-where

- https://www.fool.com/the-ascent/personal-finance/articles/how-long-does-it-take-to-become-a-millionaire/

- https://mergersandinquisitions.com/corporate-finance/

- https://www.investopedia.com/articles/basics/13/portfolio-growth-strategies.asp

- https://financialframework.com.au/become-a-smarter-investor-8-key-questions-to-ask-before-investing-your-money/

- http://cws.cengage.co.uk/megginson/students/crq_answers/crq_01.pdf

- https://www.efficientlearning.com/cfa/resources/cfa-vs-cpa/

- https://fortune.com/recommends/investing/how-much-of-your-income-should-go-toward-investing/

- https://www.investopedia.com/terms/i/investing.asp

- https://www.morningstar.com/personal-finance/which-investments-keep-out-your-taxable-account

- https://medium.com/crypto-and-money/7-proven-ways-to-make-5-000-9-000-per-month-in-passive-income-1aafbf025154

- https://dfi.wa.gov/financial-education/information/questions-ask-investing-business-opportunity

- https://www.bankrate.com/investing/important-questions-before-buying-stock/

- https://www.investopedia.com/3-fund-portfolio-401k-5409269

- https://www.wgu.edu/blog/finance-degree-difficult2301.html

- https://www.linkedin.com/pulse/breaking-corporate-finance-guide-landing-your-dream-moss-bsm-mbaf